Service

Service

The experience and understanding

of on-site accounting

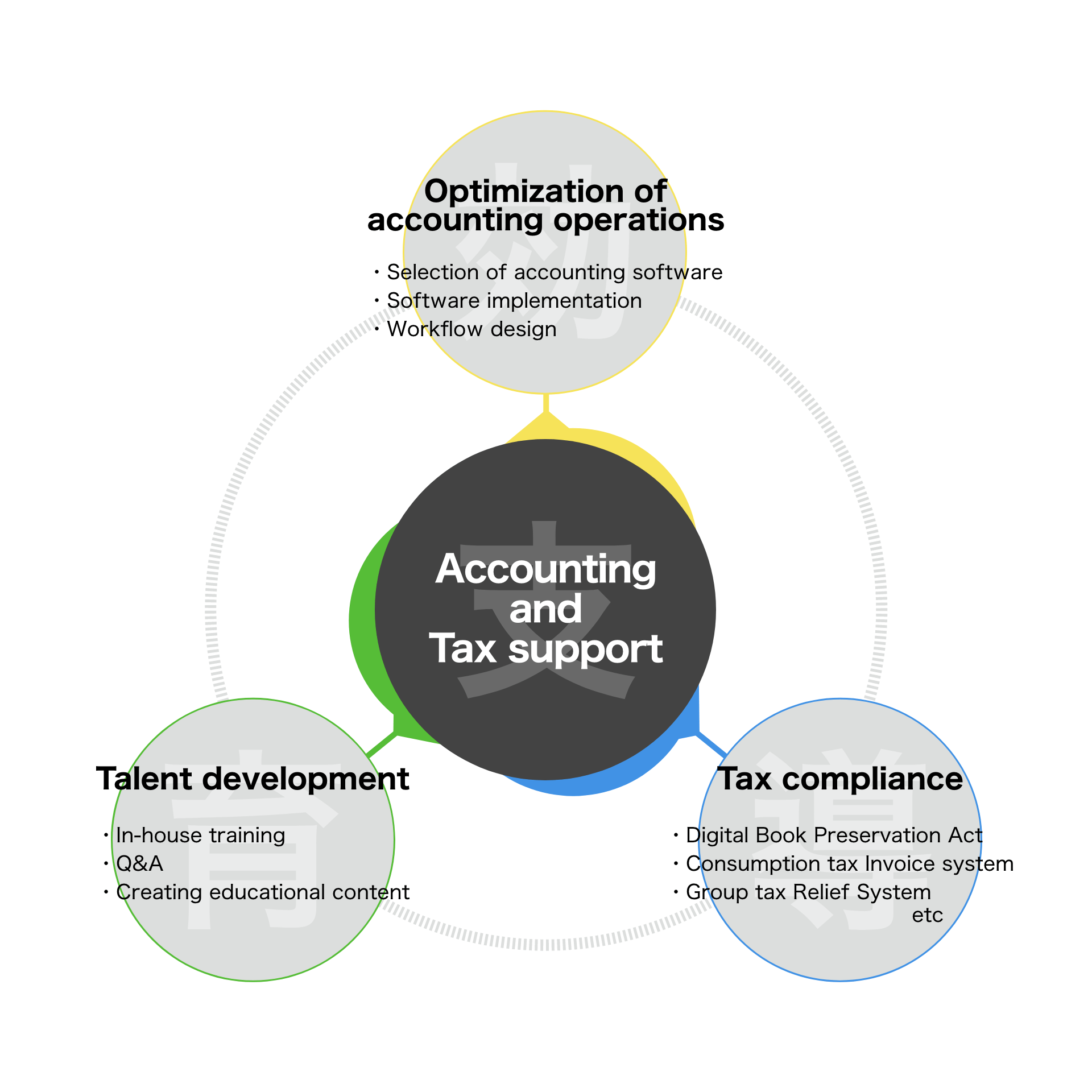

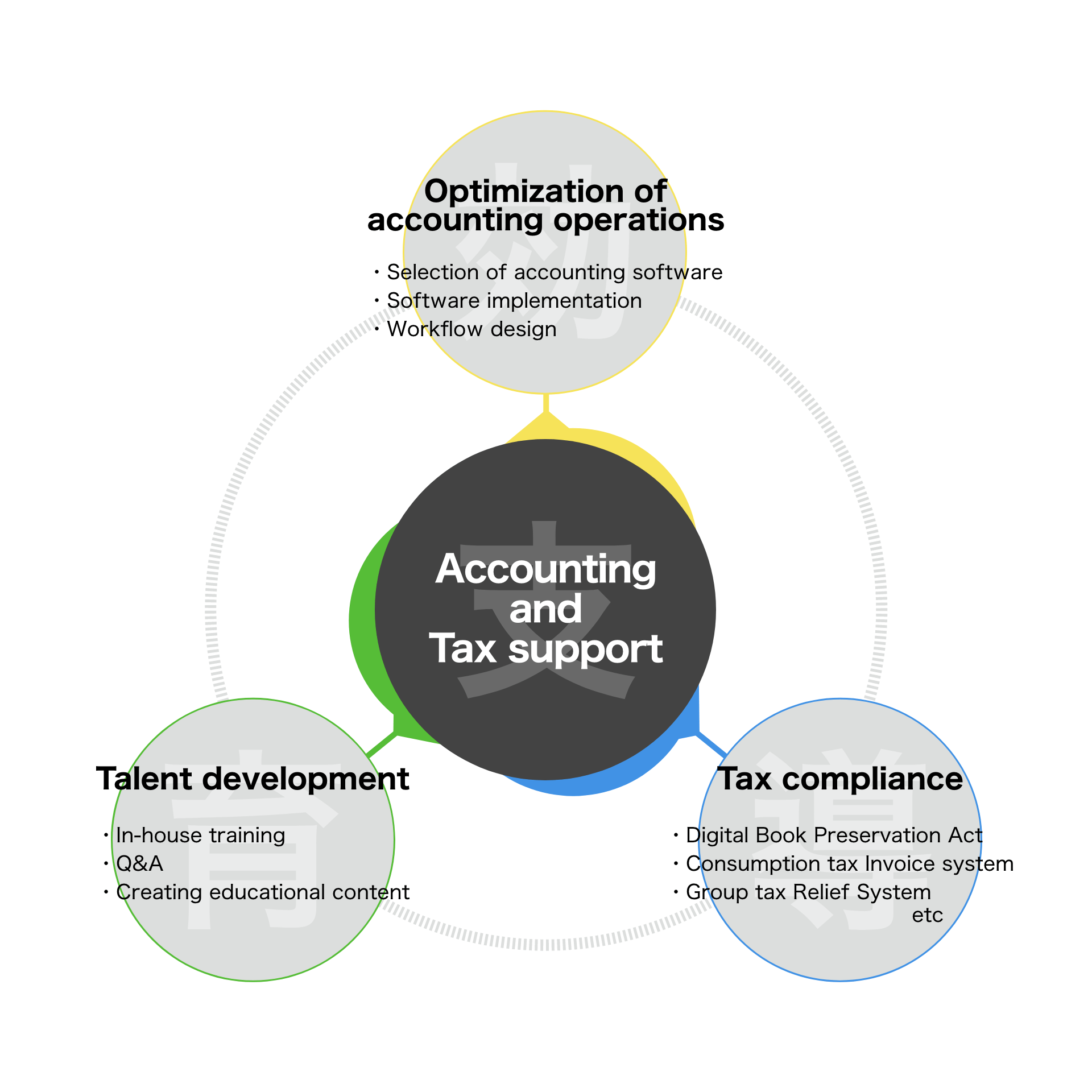

Each company has their own accounting and tax issues, where not just expertise but “on-site” experience is required. From the 25 years of experience at a trust bank and knowledge as a certified tax accountant, we will support your financial personnel in solving the challenges they face.

The experience and understanding

of on-site accounting

Each company has their own accounting and tax issues, where not just expertise but “on-site” experience is required. From the 25 years of experience at a trust bank and knowledge as a certified tax accountant, we will support your financial personnel in solving the challenges they face.

Cost Reduction Support concerning Accounting

& Tax Efficiency

The decision of implementing accounting software that fits the company is most important in accounting and tax operations. If mistaken, it could lead to inefficiency or an increase in costs. We will introduce low-cost accounting software which can be handled by beginners, and help to familiarize bookkeeping which has become increasingly complex in the recent years.

Tax consultant / Advisory

In most cases, a tax officer is regarded as a tax expert from within the company just by being appointed to the position, and is required to make tax judgments. However in order to make a decision, it is necessary to check the facts and legal interpretation, which the results are difficult to judge. We provide support as a “neighbour expert” that tax personnel can easily consult with.

Tax Reform Compliance

Support

Our Tax Reform Compliance Support service provides comprehensive assistance for addressing changes in tax regulations. This includes ensuring an accurate understanding of the system, determining how to apply it to internal rules, and establishing communication and operational frameworks. We offer tailored support for practical challenges arising from reforms such as the Consumption Tax Invoice System and the Electronic Bookkeeping Act, always staying close to the needs of tax professionals.

Support for

Foreign and Non-Japanese Companies

We assist with the establishment of Japanese subsidiaries, overseas expansion, and cross-border investments, providing accounting and tax support. Our services include helping businesses navigate Japanese tax regulations, resolve double taxation issues, and implement multi-currency accounting systems. With the ability to operate in English, we collaborate with specialists to offer seamless, one-stop solutions for addressing complex challenges.

Cost Reduction Support concerning Accounting

& Tax Efficiency

The decision of implementing accounting software that fits the company is most important in accounting and tax operations. If mistaken, it could lead to inefficiency or an increase in costs. We will introduce low-cost accounting software which can be handled by beginners, and help to familiarize bookkeeping which has become increasingly complex in the recent years.

Tax consultant / Advisory

In most cases, a tax officer is regarded as a tax expert from within the company just by being appointed to the position, and is required to make tax judgments. However in order to make a decision, it is necessary to check the facts and legal interpretation, which the results are difficult to judge. We provide support as a “neighbour expert” that tax personnel can easily consult with.

Tax Reform Compliance Support

Our Tax Reform Compliance Support service provides comprehensive assistance for addressing changes in tax regulations. This includes ensuring an accurate understanding of the system, determining how to apply it to internal rules, and establishing communication and operational frameworks. We offer tailored support for practical challenges arising from reforms such as the Consumption Tax Invoice System and the Electronic Bookkeeping Act, always staying close to the needs of tax professionals.

Support for

Foreign and Non-Japanese Companies

We assist with the establishment of Japanese subsidiaries, overseas expansion, and cross-border investments, providing accounting and tax support. Our services include helping businesses navigate Japanese tax regulations, resolve double taxation issues, and implement multi-currency accounting systems. With the ability to operate in English, we collaborate with specialists to offer seamless, one-stop solutions for addressing complex challenges.

Contact

Click on Inquiries to contact us.

We offer support, practical assistance, and lectures.

*Consultations are free of charge.

Contact

Click on Inquiries to contact us.

We offer support, practical assistance, and lectures.

*Consultations are free of charge.